nassau county tax rate calculator

Nassau County New York Property Tax Go To Different County 871100 Avg. Tax Collector Office Locations Locations in Yulee Callahan Hilliard and Fernandina Beach.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

2020 rates included for use while preparing your income tax deduction.

. Nassau County FL Property Appraiser. Even so the average effective property tax rate in Suffolk County is 237 far above both state and national averages. Our Nassau County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

The minimum combined 2022 sales tax rate for Nassau New York is 8. What is the sales tax rate in Nassau New York. How to Challenge Your Assessment.

Nassau county tax rate calculator Sunday March 6 2022 Edit. This includes the rates on the state county city and special. This is the total of state county and city sales tax rates.

The Tax Estimator allows you to calculate the estimated Ad Valorem taxes for a property located in Nassau County. The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county. 179 of home value Yearly median tax in Nassau County The median property tax in Nassau County New.

Nassau County Sales Tax Rates for 2022 Nassau County in New York has a tax rate of 863 for 2022 this includes the New York Sales Tax Rate of 4 and Local Sales Tax Rates in Nassau. You can find more tax rates and. The Nassau County sales tax rate is.

The current total local. 74 rows Nassau County New York Sales Tax Rate 2022 Up to 8875 Nassau County Has No County-Level Sales Tax While many counties do levy a countywide sales tax Nassau County. Texas has a 625 sales tax and Harris County collects an additional NA so the minimum sales tax rate in Harris.

NASSAU COUNTY ASSESSMENT REVIEW COMMISSION. STIPULATION OF SETTLEMENT CALCULATOR. Our Nassau County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax.

The New York state sales tax rate is currently. Nassau County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Nassau County totaling 1. In dollar terms Westchester.

This rate includes any state county city and local sales taxes. Assessment Challenge Forms Instructions. The 2018 United States Supreme Court decision in South Dakota v.

Nassau NY Sales Tax Rate. The average cumulative sales tax rate in Nassau County New York is 865 with a range that spans from 863 to 888.

Rockland County Ny Property Tax Search And Records Propertyshark

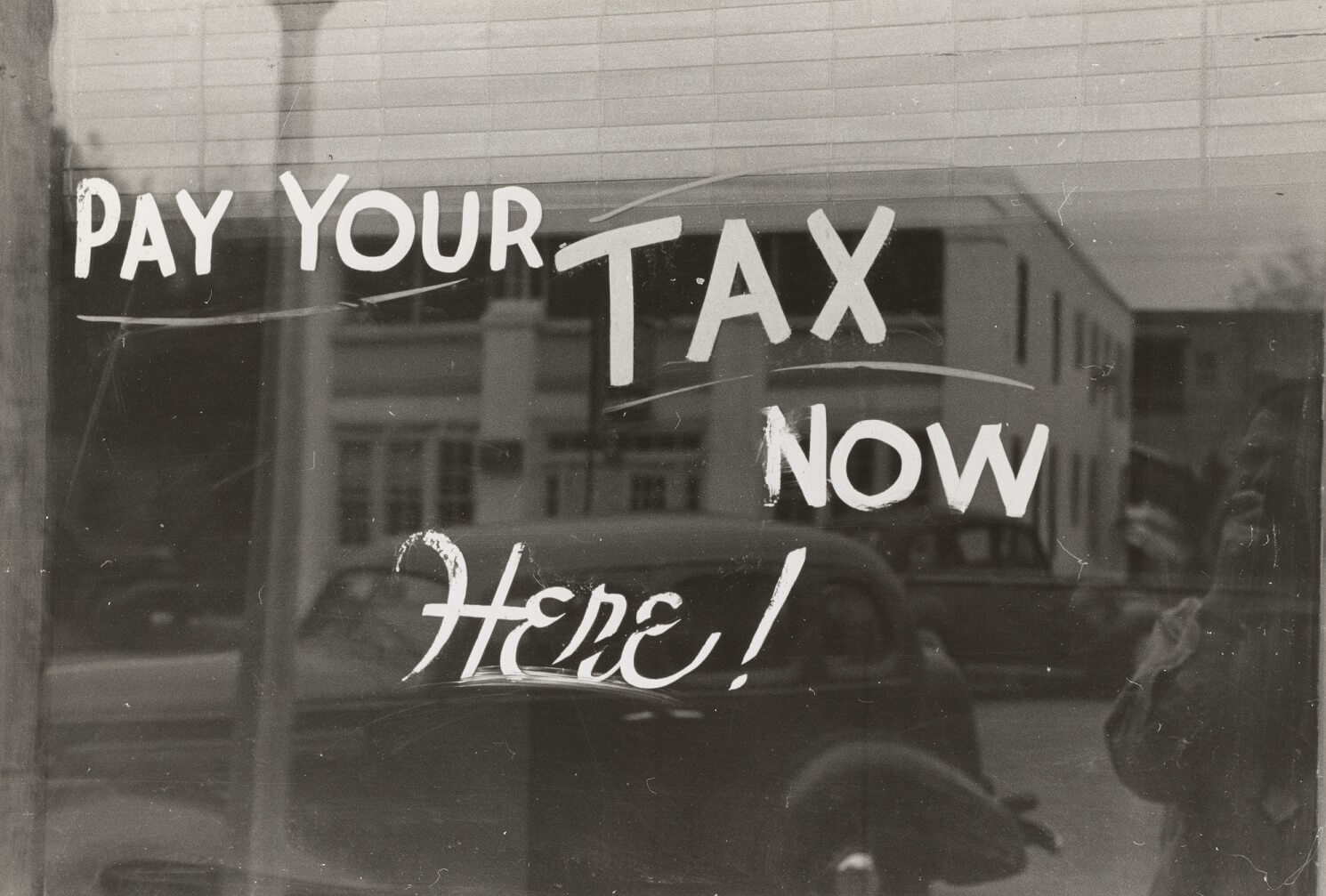

4 Options When Facing Back Property Taxes Nassau Suffolk County Ny

Property Tax How To Calculate Local Considerations

How To Calculate Fl Sales Tax On Rent

Property Tax By County Property Tax Calculator Rethority

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Harris County Tx Property Tax Calculator Smartasset

News Flash Nassau County Ny Civicengage

What Are The Taxes On Selling A House In New York

Official Records Nassau County Clerk Of Courts And Comptroller

Sales Tax Definition How It Works How To Calculate It Bankrate

Car Loan Calculator Florida Dealer Consumer Calculator

Property Tax Calculator League Of Minnesota Cities

Florida Sales Tax Rates By City County 2022